Are you preparing for a BPO job in the banking process? Whether you’re new to the industry or looking to switch roles, getting ready with the right interview questions and answers can make all the difference. Interviews can be nerve-wracking, but with a bit of preparation, you can walk in with confidence.

In this blog, we’ll cover the most common BPO banking process interview questions and answers. We’ll also share useful tips, examples, and current industry trends to help you stand out from the crowd.

What is the BPO Banking Process?

Before we dive into interview questions, let’s quickly understand what the BPO banking process involves.

BPO stands for Business Process Outsourcing. In the banking sector, it refers to the outsourcing of various banking services to third-party providers. These services may include:

- Customer service

- Loan processing

- Data entry and account maintenance

- Fraud detection

- Verification and KYC processing

With modern banks increasingly embracing digitization and cost-efficiency, BPO operations play a crucial role in keeping things running smoothly.

Top BPO Banking Process Interview Questions and Answers

1. Can you explain what the banking process in a BPO setting includes?

Sample Answer:

“In a BPO environment, the banking process covers a wide range of tasks such as handling customer inquiries, processing transactions, managing loan and credit card applications, updating customer databases, and performing compliance checks like KYC and AML. These functions help banks operate more efficiently and focus on their core tasks.”

Tip: Show that you understand how BPO services contribute to the broader banking ecosystem.

2. Why do you want to work in a BPO, specifically in the banking process?

Sample Answer:

“I’m interested in the BPO banking sector because it offers continuous learning, especially about financial systems and customer service. I’ve always been intrigued by banking operations, and I believe my communication skills and attention to detail will allow me to succeed in this role.”

Tip: Align your interests and skills with what the role requires. Passion and a willingness to learn count a lot!

If you want more guidance on framing this question, check out this detailed guide on why do you want to join BPO.

3. How would you handle a difficult customer who is upset about a failed transaction?

Sample Answer:

“I would first listen carefully to the customer to understand their issue without interrupting them. Then, I’d empathize with their frustration, reassure them that I’m there to help, and proceed to check their transaction details. If necessary, I would escalate the issue to the concerned department while keeping the customer informed throughout the process.”

Example:

Once, in a mock call scenario during training, a customer was angry about a delayed refund. Instead of getting defensive, I calmly apologized, found the issue, and helped resolve it. Later, the trainer even highlighted that call as one of the best handlings!

4. What are some common banking terms you should know in this role?

- KYC – Know Your Customer

- NEFT/RTGS/IMPS – Fund transfer methods

- Credit Score – Indicator of borrower’s creditworthiness

- Debit vs. Credit – Basic transaction types

- OTP – One Time Password for secure online transactions

Tip: Brush up on basic banking terms—it shows that you’re serious and prepared.

5. What would you do if you didn’t know the answer to a customer’s question?

Sample Answer:

“I’d politely let the customer know that I will quickly check with the right department and get back to them as soon as I have accurate information. It’s better to double-check than provide incorrect info.”

Tip: Honesty, combined with effort, works better than bluffing.

6. How do you handle repetitive tasks without losing focus?

Sample Answer:

“I usually set mini-goals, like completing a certain number of tasks within a time frame. Taking short breaks helps me reset mentally. I also remind myself that each task impacts real customers, so it deserves my best effort.”

Tip: Employers want candidates who can stay productive while doing repetitive work. Show that you have a system in place.

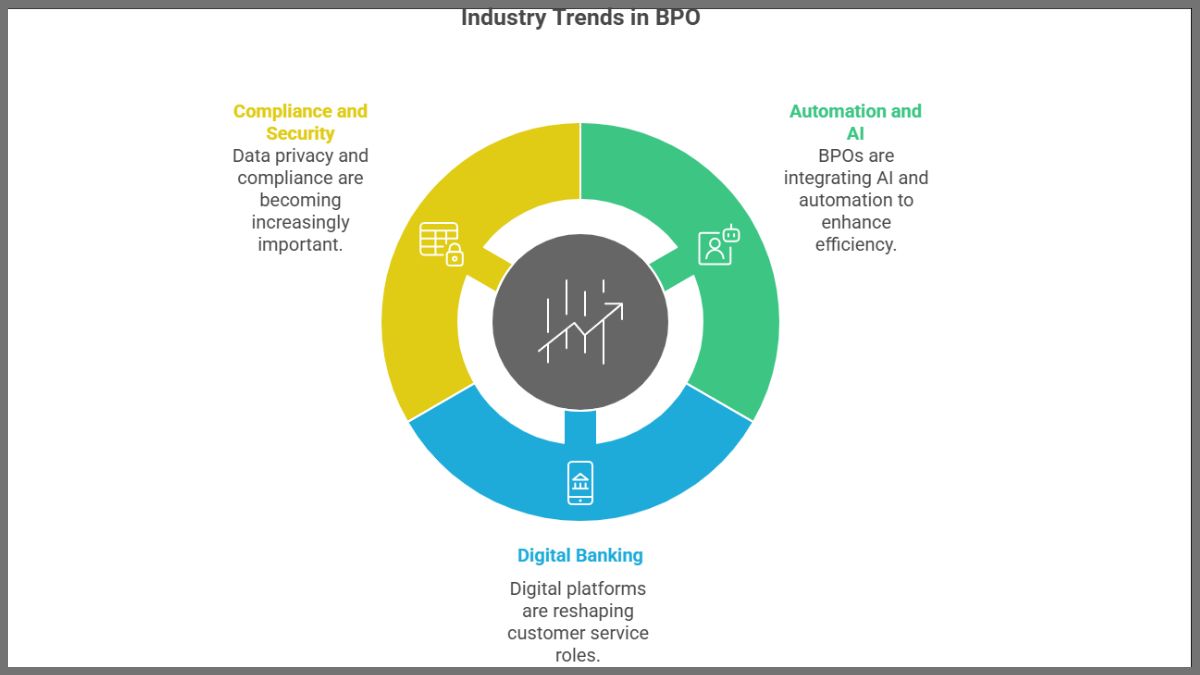

Real-Time Industry Trends to Be Aware Of

Staying informed about the latest trends can set you apart in an interview.

1. Rise of Automation and AI

More BPOs supporting banking services are incorporating chatbots, AI workflows, and RPA (Robotic Process Automation). While this may automate basic tasks, human agents are still essential for solving complex issues and delivering personalized service.

Did you know?

According to Deloitte’s 2023 Global Outsourcing Survey, nearly 53% of businesses are investing in intelligent automation to improve efficiency in customer support roles.

2. Digital Banking Boom

With neobanks and digital wallets becoming mainstream, there’s been a shift toward digital-first customer service. As a result, BPO agents must now handle both chat and email support in addition to voice calls.

3. Compliance and Data Security

With stricter regulations like GDPR and RBI guidelines in India, there’s a growing focus on data privacy and compliance. This means agents in BPOs need to be extra careful while handling sensitive information like Aadhaar and PAN numbers.

Tips to Prepare for Your BPO Banking Interview

1. Know the Company

Research the BPO firm and the banking client they represent. Understand their services, mission, and any recent news or developments.

2. Brush Up on Basics

Know basic computer skills, banking terms, and customer service etiquette.

3. Practice Communication

Since most roles involve talking to customers, your voice tone, pronunciation, and pacing matter a lot. Practicing mock calls with a friend or even recording yourself can boost your confidence.

4. Show Willingness to Learn

Many companies are more interested in your attitude than your resume. Showing a learning mindset and flexibility can work in your favor—even if you’re a fresher.

Final Thoughts

Breaking into the BPO banking process field isn’t hard—but being well-prepared can make a big difference. Focus on understanding the role, developing strong communication skills, and staying updated with industry changes.

Remember, interviews are not just about answering questions. They’re about showing the recruiter why you’re the right fit for their team.

Take a deep breath, smile, and walk in with confidence. You’ve got this!

Have a question about BPO banking interviews or want help with your resume? Leave a comment below or reach out—we’re here to help you succeed.