When it comes to money matters, customer support can make or break a customer’s trust. Whether it’s banking, insurance, or investment advice, people want quick, clear, and reliable answers. This is where financial services call centers come into play. But what are they really? And how do they operate behind the scenes?

Let’s break it all down in simple terms.

Understanding Financial Services Call Centers

A financial services call center is a hub where customer service agents help clients with money-related issues. These could range from checking an account balance to solving problems with loans or insurance policies.

Think about the last time you had to call your bank. Maybe you lost your credit card or needed help with a suspicious transaction. You likely spoke to someone trained to handle financial questions — that was a call center agent working in financial services.

These call centers are essential to keeping financial companies running smoothly. They handle a high volume of calls, emails, and even live chats from customers who need help with their financial accounts or products.

Why Financial Services Call Centers Matter

Trust is a big deal when it comes to money. If people don’t feel supported by their bank or insurance provider, they’ll go elsewhere. A great customer experience can turn a one-time caller into a loyal customer.

In the financial world, quick and accurate responses are vital. A delay in solving an issue could lead to financial loss or frustration. That’s why financial institutions invest in skilled teams and smart technology to keep things running efficiently.

The Role of Call Centers in Building Customer Trust

It’s not just about picking up the phone. These centers help build long-term relationships. Customers want to feel heard and understood, especially when it comes to their money. Financial call centers offer that human touch — trained representatives who listen carefully and offer clear solutions.

Types of Financial Services Call Centers

Not all financial call centers are the same. Depending on the company, the services may vary. Here’s a quick look at the most common types:

- Banking Call Centers: Handle everything from account balance inquiries to fraud alerts and card replacements.

- Credit and Loan Support: Assist customers with loan applications, repayment schedules, and credit score questions.

- Insurance Call Centers: Help with policy questions, claims, and premium payments.

- Investment Services: Offer support for brokerage accounts, trading queries, and general financial advice.

Each type may require specific training for the agents, especially when explaining complex products in simple terms.

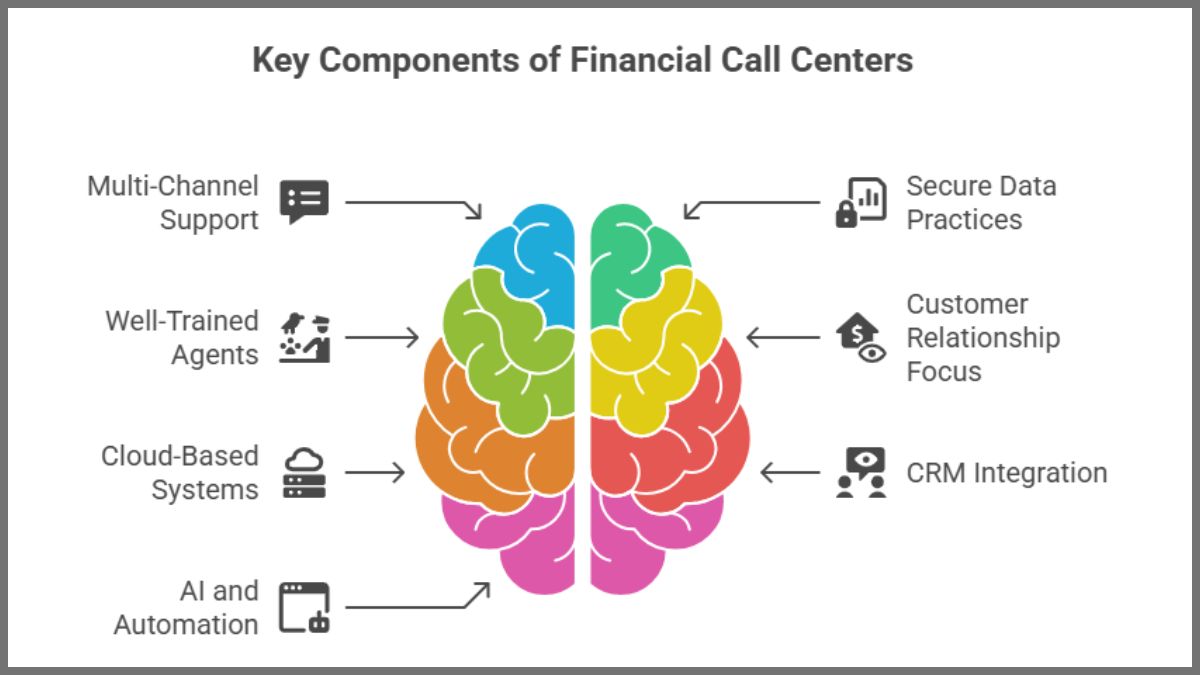

Key Features of a Financial Services Call Center

So, what makes these call centers stand out? It’s a mix of skilled people, advanced technology, and strong policies. Let’s take a closer look.

1. Multi-Channel Support

Today’s customers want choice. One person might prefer a quick phone call, while another might send a message through a mobile app. Financial call centers now go beyond just phone support. They manage:

- Voice Calls

- Emails

- Live Chats

- Text Messages (SMS)

- Social Media Messaging

The goal is to meet customers wherever they are.

2. Secure Data Practices

Handling personal financial information is serious business. Call centers must follow strict rules to keep data secure. This often includes multi-factor authentication, encrypted calls, and regular staff training on data protection.

3. Well-Trained Agents

Agents need to know more than just how to answer calls. They often go through financial product training, soft skills development, and even compliance education to ensure they’re equipped to handle sensitive situations.

4. Customer Relationship Focus

Beyond solving problems, call center agents often have sales goals, like offering new products or recommending upgraded services. They’re trained to personalize conversations and build rapport with customers, adding a personal touch to every interaction.

How Financial Call Centers Use Technology

Modern call centers aren’t just a group of people answering phones. Technology plays a huge role in speeding up service and improving the customer experience.

Cloud-Based Systems

Many financial institutions now rely on cloud call center software. This allows agents to work from anywhere, and makes scaling easier during peak times.

CRM Integration

Customer Relationship Management (CRM) tools are used to keep track of every interaction. This helps agents offer faster, more personalized service by knowing a customer’s history before they even pick up the phone.

AI and Automation

Some tasks don’t need a human touch. For example, an automated voice assistant can help reset a password or check an account balance. This frees up agents to handle more complex problems.

Benefits of Financial Services Call Centers

Setting up a call center is a big investment, but it pays off. Here’s why:

- Improved Customer Retention: Quick, helpful service keeps customers coming back.

- Better Compliance: Strict protocols help meet financial regulations.

- Increased Efficiency: With the right tools, agents can handle more calls in less time.

- Revenue Growth: Happy customers are more likely to explore other financial products.

Do you remember the last time a call center solved your problem in minutes? It likely left a positive impression. That’s the kind of service banks and financial firms aim to deliver every day. Improved efficiency often comes down to meeting strong service benchmarks. This is where call center service levels play a key role.

Challenges in Financial Call Centers

Of course, running a financial services call center isn’t without hurdles.

High Expectations

Customers expect 24/7 support. They also expect agents to understand their issues right away. Meeting this demand takes constant training, technology upgrades, and process improvements.

Staff Turnover

Like many customer service teams, turnover can be high. Keeping trained and experienced staff can be challenging, yet critical for consistent service quality.

Compliance Pressure

Financial rules and laws change frequently. Staying compliant requires continuous education and proper documentation of every interaction.

What the Future Looks Like

The financial services call center of the future will be faster, smarter, and even more customer-focused. With tools like Artificial Intelligence and predictive analytics, companies will be able to solve problems before the customer even knows there’s one.

But one thing will remain the same — the importance of the human connection. No matter how advanced technology becomes, a friendly voice on the other end of the line still makes a difference.

Final Thoughts

A financial services call center is more than just a place to get help — it’s the front line of customer experience in the banking and finance world. With the right mix of people, technology, and processes, these centers can offer faster problem-solving, better customer relationships, and improved trust.

So, the next time you call your bank and a friendly voice helps you out in minutes, you’ll know there’s a carefully crafted strategy behind that smooth experience.

If you’re in the finance industry, investing in a skilled and tech-enabled call center might just be your smartest move yet.