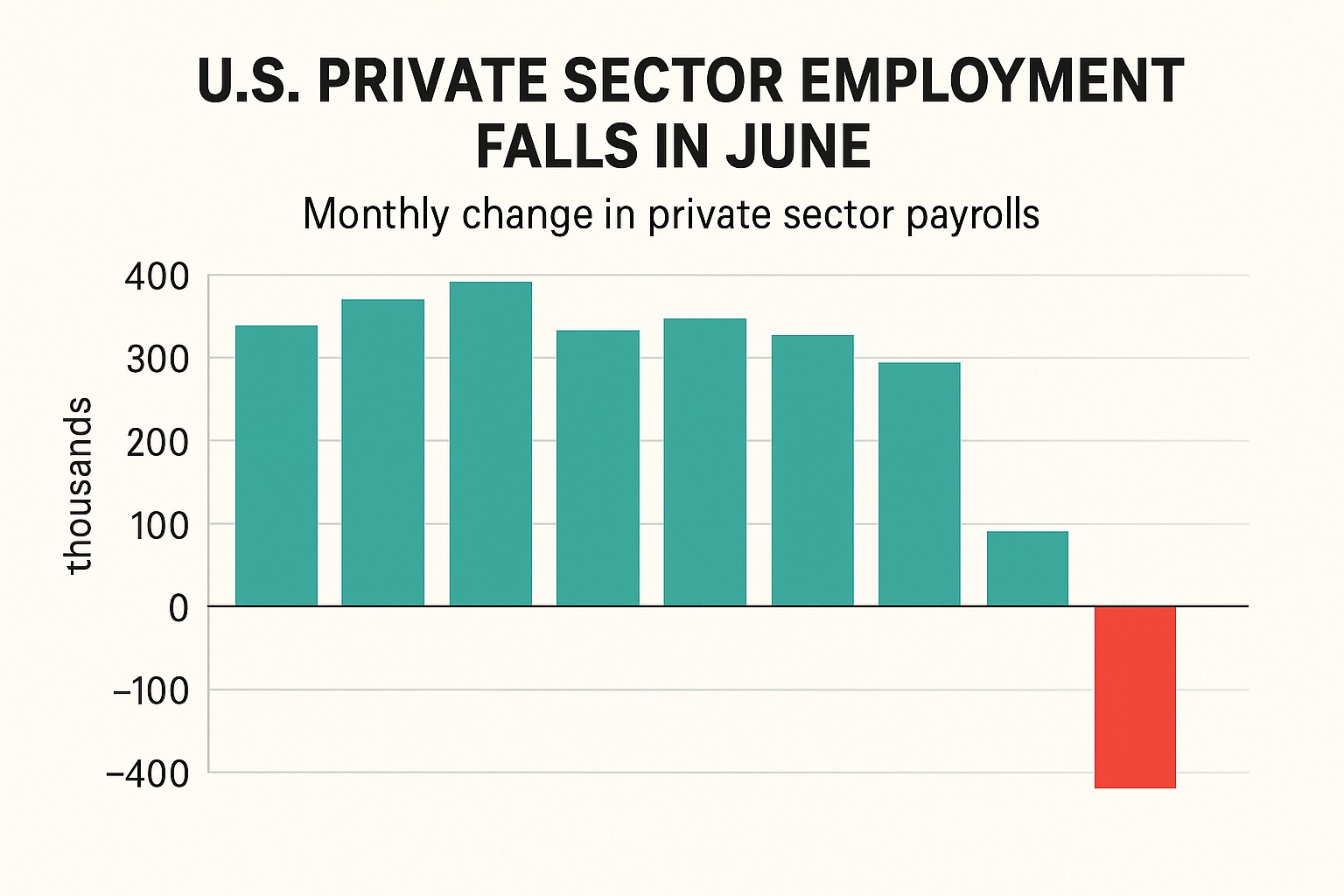

The US private sector employment landscape took an unexpected turn in June as companies shed 33,000 jobs, marking the first decline in employment in five months, according to the latest ADP National Employment Report released Wednesday. The report, produced by the ADP Research Institute in collaboration with the Stanford Digital Economy Lab, offers a detailed snapshot of hiring and pay trends across the private sector.

Key Highlights:

-

Annual pay rose 4.4% in June compared to a year ago, continuing the cooling trajectory that started in 2022.

-

The services sector, which has largely fueled job growth over the past year, experienced the biggest contraction.

-

Construction and natural resources sectors remained resilient, adding thousands of positions despite broader hiring cutbacks.

According to Nela Richardson, Chief Economist at ADP, “The labor market is progressing toward greater balance. Hiring is slowing, and wage growth continues to decelerate.”

Below is an outline of the June 2025 report’s most important specs and features:

June 2025 ADP US Private Sector Employment Report: Specs & Features

Overall Employment Change:

-

Total private sector jobs lost: 33,000

-

First decline in employment since January 2025

Pay Growth:

-

Annual pay increase: 4.4% year-over-year

-

Down from a peak of over 7% in 2022

-

Wages rose at the slowest pace in more than three years

Sector Performance:

-

Services Sector:

-

Lost 71,000 jobs

-

Largest losses in trade, transportation, and utilities (-36,000)

-

-

Construction:

-

Added 27,000 jobs

-

-

Natural Resources and Mining:

-

Added 9,000 jobs

-

Company Size Trends:

-

Small Businesses (1–49 employees):

-

Net gain of 5,000 jobs

-

-

Medium Businesses (50–499 employees):

-

Shed 52,000 jobs

-

-

Large Businesses (500+ employees):

-

Gained 14,000 jobs

-

Regional Insights:

-

The South and Midwest recorded the largest declines.

-

The West showed modest gains driven by construction hiring.

Annual Pay Growth by Sector:

-

Leisure and hospitality: 5.1% increase

-

Manufacturing: 4.2% increase

-

Professional services: 3.8% increase

Economic Context

The report suggests that employers are taking a cautious approach amid signs that the US economy is slowing. Recent data from the Bureau of Labor Statistics and the Federal Reserve also point to cooling demand for labor as inflation recedes and interest rates remain elevated.

While the slowdown in hiring may ease pressure on the Fed to keep rates high, it also underscores uncertainty about whether the U.S. can maintain low unemployment without reigniting inflation.

ADP’s report, which is based on anonymized payroll data covering more than 25 million workers, often serves as an early indicator of broader labor market trends ahead of the government’s monthly jobs report.

As Richardson emphasized:

“Wages are still rising but not as fast, and job growth is no longer uniform across industries.”

This uneven employment picture could persist into the second half of the year, reflecting a shift away from the red-hot labor market that defined the post-pandemic recovery.

For a detailed view of the June data, you can access the full ADP Employment Report.

Conclusion

With US private sector employment falling for the first time in months and pay growth continuing to slow, economists and policymakers will be watching closely to see whether this is a temporary pause or the start of a more pronounced cooling trend.

Stay tuned for the upcoming Labor Department report, which will provide further insight into broader employment patterns.